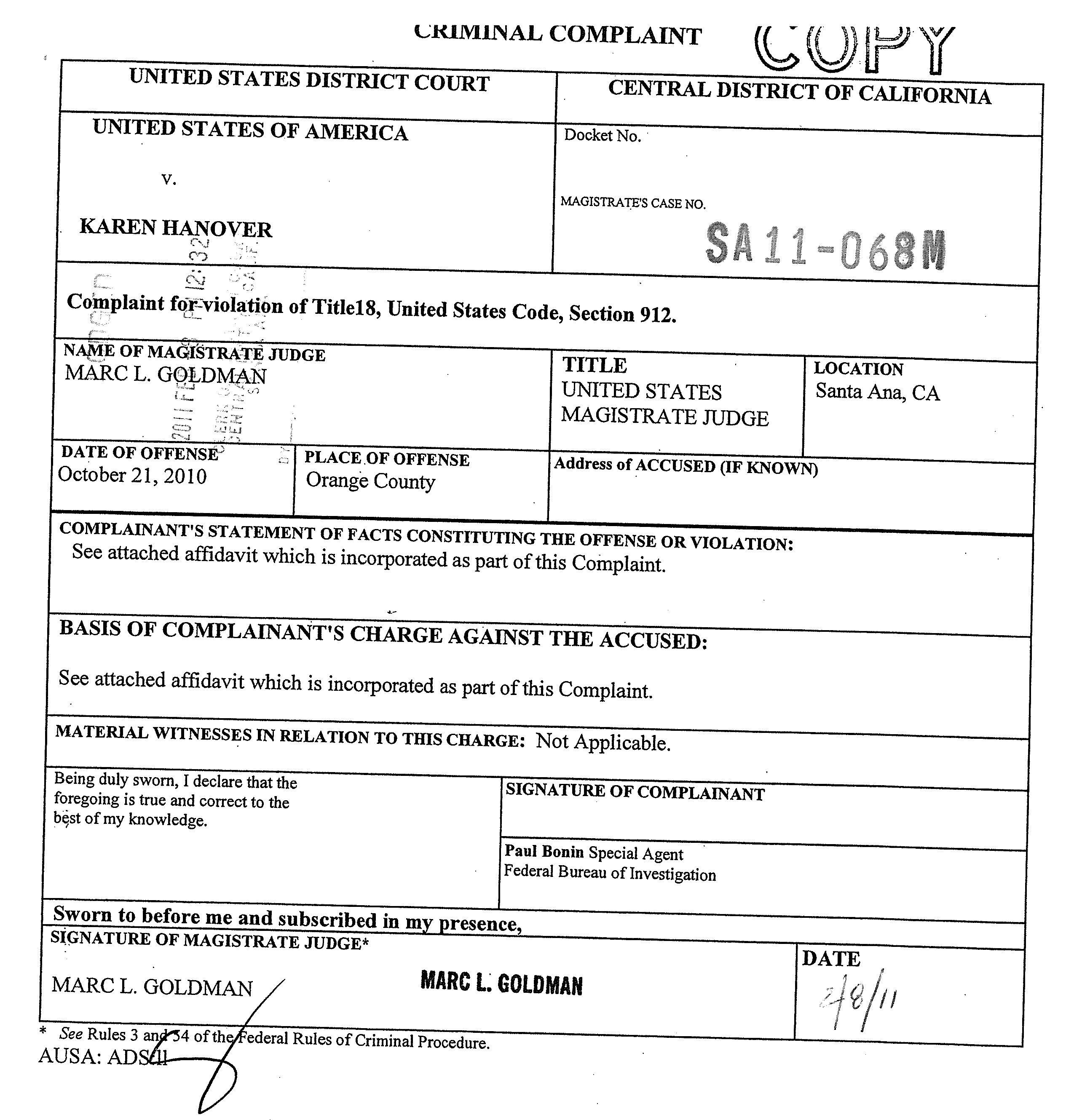

I once had the unfortunate experience of crossing paths with the recently ‘re-indicted’ Karen Hanover. If you do not know who Ms. Hanover is and what she did to many unsuspecting real estate investors, you must read my friend, Duncan Wiermans’s blog (www.duncanwierman.com/blog). I would have to say that virtually single-handedly, Duncan was the one who brought about Karen Hanover’s demise and her subsequent trip to the slammer.

Several years ago, I was approached by a real estate guru (who shall remain nameless) regarding one of my complexes. He had this great idea as to how he could find government money for repairs that needed to take place on the property. During our conversations, he mentioned in passing that his time was limited because he was attempting to negotiate a multifamily transaction in Arizona with another guru named Karen Hanover. At the time, I knew next to nothing about Ms. Hanover.

Later on, Ms. Hanover’s ‘Gold Rush’ program was brought to my attention. Even though I had been involved in hundreds of multifamily deals, I had trouble understanding exactly what it was that she was ‘selling’ to her students or investors. It was obvious to me that the results that she was offering if you signed up with her could never be achieved.

Was it a training program to teach students how to buy multifamily property that she was offering for $30,000? Was it a membership interest in a property that entitled her students to be members of a limited liability company that was going to own the property?

It was impossible to determine exactly what her students were signing up for and that probably was part of her criminal mastermind plan. Nobody asked the tough questions and if they did, Ms. Hanover would come at them with daggers (see some of Duncan’ s blog posts). Unfortunately, this is the problem with so many ‘bootcamp’ attendees. They will believe anything their itching ears want to hear. “You mean, all I have to do is give you $30,000 and you will get me into a multifamily deal? Where do I sign up?”

Let me stop you right here. If this is how you would like to get into multifamily investing, please let me know so I can remove you from all future correspondences from my law firm and my educational company. Owning multifamily property is a business. It’s a great business. But it’s a business. One that, when done correctly, will provide you and your family a lifestyle like no other business around. So do not try to cut corners. Nothing good ever came from taking the easy road.

Back to our story. At about the time that Duncan Wierman started exposing Karen Hanover and the fraud that she was perpetrating on her students, I received an email from Ms. Hanover requesting my assistance. I guess she had heard that I was successful in working with other investors and helping them get into apartment deals.

Her email to me talked about how she was putting together a reality TV show, how she had interviewed with Oprah and on and on and on. It was the type of letter that would make many people sit up and take notice. I’ve seen enough ‘posers’ in this business that the letter made me question all that she was talking about.

After doing a little more internet research on Karen after she had contacted me, I happened to find a purchase and sale agreement online for an Arizona property that she had made an offer on. It turns out, this was the same property that the government guru that I had mentioned was attempting to get under contract with Ms. Hanover.

After reading the contract, it became very evident that both Ms. Hanover and the other guru were clearly out of her league when it came to buying multifamily property.

Two things stood out like sore thumbs. First, the amount of the earnest money being offered was $500.

Now let me be clear with this. I always recommend to my students and clients that you offer as little in the way of earnest money that you can. The situation regarding the property will dictate the amount of earnest money that will be required and what you should offer.

If you are working directly with the Seller, you may be able to get very creative on the earnest money deposit terms. For instance, I have seen accepted offers where the earnest money was to be delivered in the form of a check to be “held” at the office of the Buyer’s attorney. The Buyer’s attorney was directed to ‘hold’ the check, not cash it, just to hold it.

Not bad. I bet the Buyer wished the Seller would do the same with the down payment check. Not likely.

If you are working directly with a broker, chances are that the earnest money requirement will be at least one percent of the purchase price. If you were to offer $500, as Karen did, your offer will be presented but probably disregarded as not being a legitimate offer (Remember, your job is to get the offer accepted. In order to do that, you must understand your audience. A broker has to show the Seller that there is value in using his services. An offer that would tie up the Seller’s property for months at the risk of $500 would not be looked too highly upon by most Sellers, therefore, the earnest money deposit for a property being marketed by a broker needs to be higher).

Finally, the property that Karen was making an offer on was bank-owned. If you show up to a bank to make an offer on a multifamily bank-owned property with $500 for earnest money, I can bet you ‘dollars to doughnuts’ that your offer will be soundly rejected (of course, there will be some that will read this and tell me about a property that their brother-in-law’s friend’s mother once purchase for $500. Great, congratulations, this, though, is the real world.)

The second thing that stood out like a sore thumb was Karen Hanover’s financing contingency. She was requesting approximately 107% financing on the deal. In other words, she was planning on walking away from the closing table with cash in her pocket.

If this was a three million dollar deal (which I seem to remember that it was), Karen would have another payday of $210,000 in addition to all the $30,000 students (fifty of them) who paid to watch her work her magic and buy a property for no money down. Brilliant. Criminally brilliant.

Here are your takeaways:

- Understand the audience of your offer and make sure that your terms work accordingly,

- In today’s market, any loan-to-value ratio in excess of 85%, is probably a ‘pipe-dream’; be very skeptical. So if someone is offering 100% financing, call me. Not because I am going to do business with that company, but so that I can add that company to my Buyer Beware List, and,

- If anything sounds too good to be true, it is. Before you write a check for all of your ‘gut-money’, do more research. Call me, bounce the idea off of me and I will give you my thoughts on the transaction.

I hope this has been helpful. As with any multifamily acquisition matter, we are prepared to help you in way we can.